- Do Something Newsletter

- Posts

- 🚧 Redevelopments: Turning Tired Buildings Into Value Add Winners

🚧 Redevelopments: Turning Tired Buildings Into Value Add Winners

Plus, a case study from one of our projects.

Happy new year 🎆🍾! We hope your new year’s resolution has survived the 6th day.

In the last two issues, we talked about:

Adding a second door on the same dirt with ADUs, and

Squeezing more value from existing footprints with microunits.

This week, we zoom out and tackle a bigger play:

Redevelopment

Taking a tired or underperforming property and repositioning it so it fits what today’s renter actually wants.

When done well, redevelopment can:

Compress 10 years of rent growth into a 2 to 3 year plan

Transform a “problem child” asset into a lender friendly performer

Set you up for a refinance or sale at a much higher valuation

🧱 What is a redevelopment, really?

Redevelopment sits between a light value add and true ground up construction.

You are typically:

Keeping the main structure and bones

Updating systems, interiors, curb appeal, and sometimes unit mix

Fixing functional issues that hold back rents and occupancy

Three common types:

Deep cosmetic and systems upgrade

New exteriors, roofs, windows, interiors, common areas, plus major repairs that get you out of constant maintenance mode. I do a lot of these and the upside is amazing when done right!Reconfiguration of layouts or unit mix

Splitting oversized units, combining odd layouts into something that makes more sense, or shifting from mostly studios to more family friendly mix.Use conversion

Turning obsolete office, motel, or retail into apartments where zoning allows and demand supports it.

The goal is the same: take something the market is discounting and turn it into something the market will pay a premium for.

🏚 ➜ 🏡 Example: From tired 1970s box to competitive workforce housing

You buy a 48 unit 1970s garden style property just outside a growing city.

Before:

Average rent: $950 per month

Physical occupancy: 88%

Constant work orders, dated interiors, no real amenities

Exterior looks tired, parking lot is cracked, signage is old

You execute a 24 month redevelopment plan:

New exterior paint, signage, and LED lighting

Resurfaced parking lot and upgraded landscaping

Interior upgrades on turnover units: LVP flooring, new cabinet fronts, modern fixtures, fresh counters and paint

Simple but attractive amenities: picnic area, dog station, small fitness room in an unused storage space

Cleaned up operations, brought in a stronger manager

After stabilization:

Premium units leased at $1,250 per month

Classic but well maintained units averaging $1,050 per month

Occupancy stabilizes around 95%

Maintenance calls decline as old systems are replaced

Income did not jump overnight, but over 2 years, the property moved from:

Thin cash flow and constant headaches

toReliable income, better tenant profile, and a much more attractive asset for lenders and future buyers

This is the kind of “boring but powerful” redevelopment that quietly builds wealth.

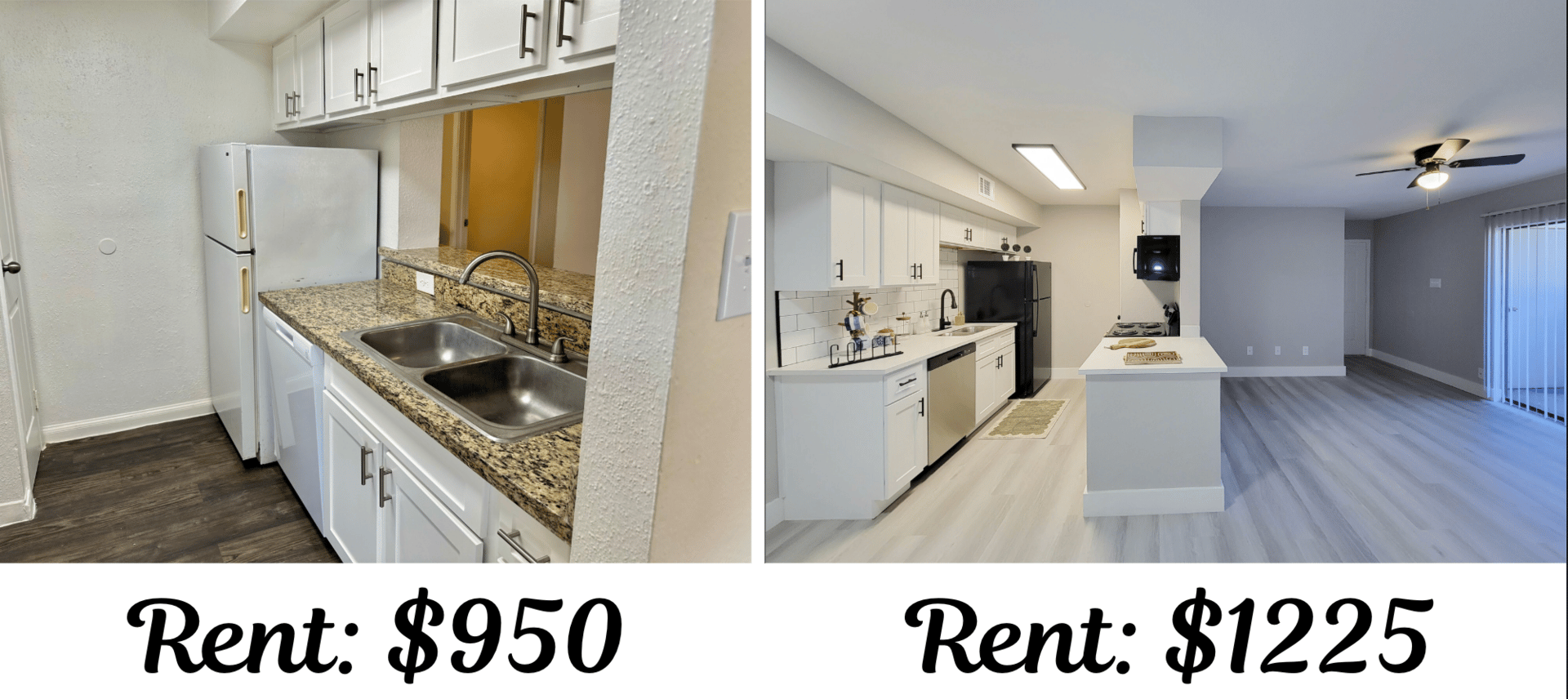

Our Practical Case Study: My team has executed this play many times. The comparison below shows how rents at our recently acquired 224 unit property stack up against the rents currently being achieved in newly upgraded units.

This is a true redevelopment play. A real value add where we are forcing appreciation.

Here is the simple math: by upgrading this unit and increasing rents by $275, we have raised net operating income by $3,300 per year ($275 × 12) per unit. At a market cap rate of 6%, that single unit upgrade adds roughly $55,000 to the property’s value.

Our plan is to renovate 134 units. At $55,000 of value per unit, that is about $7,370,000 in additional valuation. You read that right. A $7.37 million increase in value from executing just part of the business plan.

In the first three months of ownership, we have already completed 16 units, with 5 more scheduled to finish before month end, and the new units are leasing up at a healthy pace.

By the way, congrats again to our investors who participated in this deal.

I put together an investing guide that walks through exactly how value is created in multifamily through redevelopments and unit upgrades. If you want a deeper look at how this kind of valuation jump is achieved, you can read the guide here. No registration required, it is a direct link.

🏢 ➜ 🏘 Another Scenario: Underused office wing turned into high demand microunits

You control an older mixed use building near a hospital and university.

Before:

One floor is chopped into small, outdated office suites

Office tenants have mostly moved to newer buildings

That wing is 70% vacant and barely covering its share of expenses

You work with an architect and city planners to convert that wing into 10 microunits:

Each unit around 380 to 420 square feet

Modern finishes, built in storage, and efficient kitchenettes

Shared laundry and a small resident lounge on the floor

After stabilization:

Each microunit rents at a price point that healthcare workers and grad students can afford

The once struggling office wing is now a 10 door residential income stream

The building as a whole looks healthier on a profit and loss statement and to lenders

You did not scrape the building. You simply redeployed underperforming square footage into what the local demand actually wants.

🛠 What actually happens in a redevelopment?

From a landlord’s perspective, redevelopments usually involve four categories of work:

Life safety and structural

Roof, structure, wiring, plumbing, fire systems

Things that keep people safe and stop your insurance company from panicking

Curb appeal and common areas

Paint, facades, signage, landscaping, lighting, lobbies and halls

What prospects see in the first 30 seconds

Unit interiors

Floors, cabinets, counters, fixtures, appliances, bath refresh

The “Instagram test” for your target renter

Function and operations

Parking layout, trash, storage, mail, laundry, office flow

Management systems, software, and staffing

You do not need to do everything at once, but your redevelopment plan should have a clear map across these categories.

⚠️ Key risks and how to keep them in check

Redevelopments can create big upside, but they also carry real risk. A few points to respect:

Cost overruns

Old buildings hide surprises. Build contingency into both time and budget. Get multiple bids and reference checks for your general contractor.Scope creep

It is easy to keep saying “while we are at it, let’s also do…”

Define a base scope tied to your business plan and returns. Everything else is a conscious “nice to have” decision.Lease up assumptions

Underwriting that assumes every upgraded unit will instantly achieve top dollar can get you in trouble. Use realistic rent comps and give yourself some runway.Permits and approvals

Changing use, adding units, or touching structural items can trigger deeper review. Bring your architect and contractor into planning conversations early.Resident disruption

Existing tenants will be living through construction dust, noise, and inconvenience. Clear communication, temporary accommodations where needed, and fast execution all matter.

🧭 When does a redevelopment make sense for you?

Redevelopment can be a powerful move if:

You own or can buy at a basis that leaves room for construction and profit (in our case study, we bought the asset at a cost basis of $74,000 in a $95,000 market for similar type/condition)

The location is fundamentally sound, but the physical asset is lagging behind the neighborhood

Rents in the area support higher levels after renovation

You have or can hire an experienced project manager or general contractor

It may not be the right fit if:

You are early in your investing journey and short on capital reserves

The neighborhood is declining, not improving

Your plan relies on “perfect execution” with no delays or surprises

Lenders are not comfortable with your experience or the plan

Redevelopment is not the first tool every investor should grab, but it is one of the most powerful once you have a team and a process.

👇 What you can do this week

If you own or are looking at older properties:

Walk one asset with “redevelopment eyes”

Ask: “If this building matched the best nearby comps, what would it look and feel like?”

Note the biggest visual and functional gaps.

Separate must fix from value add

List life safety and structural items you must address anyway.

Then list optional upgrades that would move rents and tenant profile.

Run a simple before versus after sketch

Current average rent, occupancy, and expenses.

Target rent and occupancy after a realistic scope.

Rough project cost.

See if the new income profile justifies the spend.

In upcoming issues in this series, we will move into:

House hacking paths that let you live for less and learn faster, including how I walked away with roughly $237,000 in pure profit from my first house hack after about two years.

Seller financing structures that can make deals pencil when bank terms are tight.

If you have a property you are considering for redevelopment, you can reply to this email with a quick description. In a future issue, we may break down a sample project in more detail so you can see exactly how the numbers and decisions line up.

🙏🏾 Thanks for reading!

Stay in the loop with us! If you’ve received this newsletter from someone else, subscribe here. If you think this might help someone you know get started, consider sharing it to them using the links at the top of the page.

Stay blessed and Do Something!

— Dami Fadipe