- Do Something Newsletter

- Posts

- 💡🏙️ Turning Tough Markets Into Opportunity

💡🏙️ Turning Tough Markets Into Opportunity

Creative Strategies for Landlords in Areas Where the Numbers Just Don't Add Up.

In our previous issue, we talked about how some cities are fantastic landlord markets on paper, while others look “too expensive” based on simple rules of thumb like price-to-rent ratio.

But here’s the nuance that experienced investors know: even in high-priced, low-yield markets, the right strategy can turn a thin deal into a lucrative one. That’s where creative approaches come in.

Today’s issue is a primer on five powerful strategies you can use to unlock returns in both “easy” and “hard” markets:

Accessory Dwelling Units (ADUs)

Microunits

Redevelopments

House hacking

Seller financing

We’ll introduce each concept from a landlord’s perspective and show how it can move the needle on cash flow, equity, and long-term wealth.

1️⃣ 🏡 ADUs: Squeezing More Income Out of the Same Dirt

Accessory Dwelling Units (ADUs) are secondary units on the same lot as a primary home or main building. Think backyard cottages, garage apartments, or a converted basement with its own entrance.

Why landlords love them:

ADUs allow you to increase rental income without buying more land. In tight markets where land is the main cost driver, adding a small, efficient unit can dramatically improve your total return.

Example:

You own a single-family rental that barely breaks even in a high-priced market. By adding an ADU at the back:

Your total monthly rent increases

Your fixed expenses (taxes, insurance, land cost) are spread across two income streams

Your overall yield jumps, even if the ADU adds some debt or construction cost

This can turn a “meh” deal into a solid performer, especially over a longer hold period. If you’re in a tax aggressive township, you might get a wandering eye on this one. But generally you should be fine.

2️⃣ 📦 Microunits: Smaller Footprint, Stronger Per-Square-Foot Rent

Microunits are intentionally smaller apartments designed for efficient living in prime locations. The key is not just cutting size, but adding thoughtful design and modern finishes so they feel premium, not cramped.

Why landlords love them:

Even if the absolute monthly rent is lower, microunits often command higher rent per square foot. That means you can generate strong revenue from a smaller, more cost-efficient footprint.

Example:

Instead of four large two-bedroom units, a building might be reconfigured into six microunits targeted at young professionals or students. Total rent can increase, vacancy risk can decrease (more units, more diversification), and the building can become more attractive to institutional buyers looking for urban infill or workforce housing.

Redevelopment is about taking an underperforming or outdated property and repositioning it to meet today’s demand. This could be:

Converting an older office building into apartments

Updating a C-class property to a clean, durable B product

Reconfiguring layouts to better match what renters want today (open living space, work-from-home nooks, amenity upgrades)

Why landlords love them:

Redevelopment can compress a decade of rent growth into a two- to three-year value-add plan. You’re not just clipping coupons on existing income; you’re creating future income and equity by upgrading the property’s potential.

Example:

A dated 20-unit building with below-market rents and high expenses can become a stabilized, modern asset with stronger rents, lower maintenance issues, and higher appraised value, justifying a refinance or profitable exit.

4️⃣ 🔑 House Hacking: Training Wheels for New Landlords

House hacking is most commonly used by newer investors: you live in one part of the property (a unit, a floor, or a room) and rent out the rest to cover or subsidize your housing cost.

Why landlords love it:

This strategy allows you to:

Get into the game with lower down payments (often owner-occupied loan programs)

Learn property management hands-on with lower risk

Build equity and track record that can fuel larger acquisitions later

Example:

A fourplex where you live in one unit and rent the other three can allow you to live cheaply or even for free, while the property cash flows and appreciates. For many investors, this is how they acquire their first multifamily building.

Over time, you move out, keep the property as a full rental, and now you’ve got a fully tenant-occupied asset supported by better financing terms secured when you were an owner-occupant.

Love that. Here is a short paragraph you can drop under the House Hacking section:

Quick side note for those who are newer to our world: my very first real estate deal was a house hack. I lived in the property, rented out the other units, and sold it after about two years, walking away with roughly $237,000 in pure profit. Many of you know that story already, but for those who do not, I will be breaking down exactly how I structured that deal, what I did right, and what I would do differently in an upcoming issue. Stay tuned!

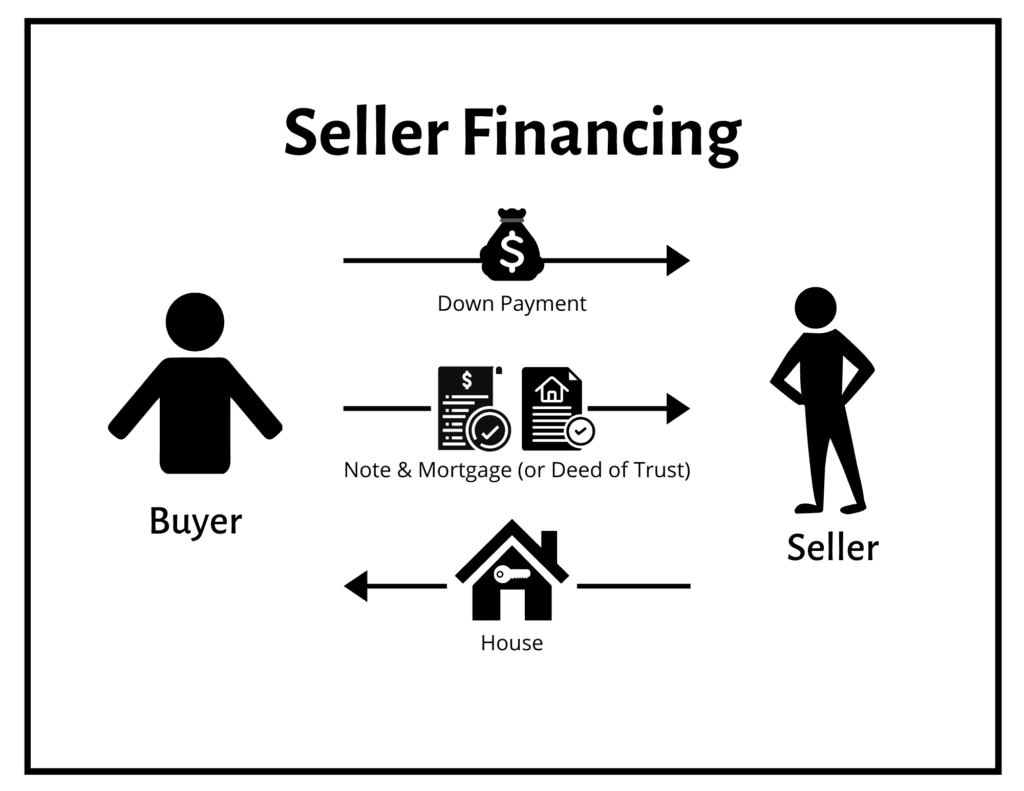

5️⃣ 🤝 Seller Financing: Making the Numbers Work When Banks Say “No”

Seller financing (or owner financing) is when the seller effectively becomes the lender. Instead of you borrowing from a bank for the full amount, the seller carries a note (debt) for part or all of the purchase price.

Why landlords love it:

It can mean more flexible terms: lower interest rate, longer amortization, interest-only periods, or lower down payment

It can help you close deals that wouldn’t work with traditional bank financing, especially in tight credit environments

Sellers can benefit from steady income and potential tax advantages by spreading out their capital gains

Example:

You find a property in a strong rental area, but conventional financing at today’s interest rates would produce skinny or negative cash flow. A seller who owns the property free and clear might agree to carry a note at a more favorable rate with interest-only payments for a few years, giving you time to stabilize rents and improve operations. Suddenly, the deal becomes viable.

🎯 Why These Strategies Matter in “Tough” Markets

In high price-to-rent markets, basic buy-and-hold with conventional financing often doesn’t pencil. But when you combine:

Additional income from ADUs or microunits

Forced appreciation through redevelopment

Lower entry barriers via house hacking

Better terms through seller financing

you can turn markets that look unattractive on paper into fertile hunting ground- if you have the right plan, team, and risk controls.

🔍 What’s Next: Deep Dives, Case Studies, and Checklists

Today’s newsletter is the overview. In upcoming issues, we’ll go deeper into each strategy, including:

ADU feasibility and permitting checklists

Design and layout ideas that make microunits feel premium, not cramped

Redevelopment pro-formas and risk flags to watch for

House hacking paths that set you up to scale beyond your first property

Seller-financing structures, term sheets, and negotiation tips

Creative strategies like ADUs, microunits, redevelopments, house hacking, and seller financing can make deals in challenging markets highly lucrative. Keep an eye on this space. Over the next few issues, we’ll discuss these approaches with real numbers, examples, and frameworks you can use in your own investing. This will be in a series format.

If you’d like a specific strategy covered first, reply to this email and tell us what you’re most curious about.

🙏🏾 Thanks for reading!

Stay in the loop with us! If you’ve received this newsletter from someone else, subscribe here.

Stay blessed and Do Something!

— Dami Fadipe