- Do Something Newsletter

- Posts

- 💡🏙️ Turning Tough Markets Into Opportunity: Case Study

💡🏙️ Turning Tough Markets Into Opportunity: Case Study

How To Add One More Door Without Buying More Land with ADUs

In our last issue, we promised to go deeper into the creative strategies that can turn tough markets into opportunity for landlords and small-to-mid sized investors.

We are starting with one of the most practical plays on that list:

Accessory Dwelling Units, also known as ADUs.

If you have ever looked at a backyard, a side driveway, or a big unfinished basement and thought, "There is another rental here," this one is for you.

Here is what we will cover in this issue:

What ADUs are and why they matter for landlords

A simple feasibility checklist before you spend a dollar

A plain English look at permitting and zoning

A sample ADU deal to show how the numbers can work

Common pitfalls to avoid

💡 What is an ADU and why should landlords care?

An ADU is a secondary residential unit on the same lot as an existing primary home or building. In practice, that can look like:

A small stand-alone unit in the backyard

A garage or carport converted into a studio

A basement apartment with its own entrance

A side addition with a separate kitchen and bathroom

From a landlord perspective, an ADU is simply another rentable door on the same piece of dirt.

That matters because in many markets, land and site work are the most expensive line items. By adding an ADU, you are:

Increasing income

Using land you already own

Spreading fixed costs (taxes, insurance, landscaping, some utilities) across more rent

The result is often a higher total yield on the property and a more resilient asset. If one unit is vacant, the other unit helps carry the note.

💡☕ Side note- story time!

Back when I was still doing single-family deals, I stumbled into a 4-bedroom house that had just cleared probate. The granddaughter inherited it and had one requirement: cash only.

One of my wholesalers tipped me off, so I scheduled a tour. While everyone else was walking through thinking “standard house,” my investor brain saw something hiding in plain sight: a walkout basement with enough bones to be its own space, plus a kitchen and bathroom already down there.

Translation: this was not just a 4-bedroom house. This was a house with a bonus unit waiting to happen.

So I did what I do. I converted that walkout basement into a true ADU: added a two-zone mini-split, furnished it, installed a sub-panel to separate electric, and tied in new plumbing for washer and dryer to make it fully functional.

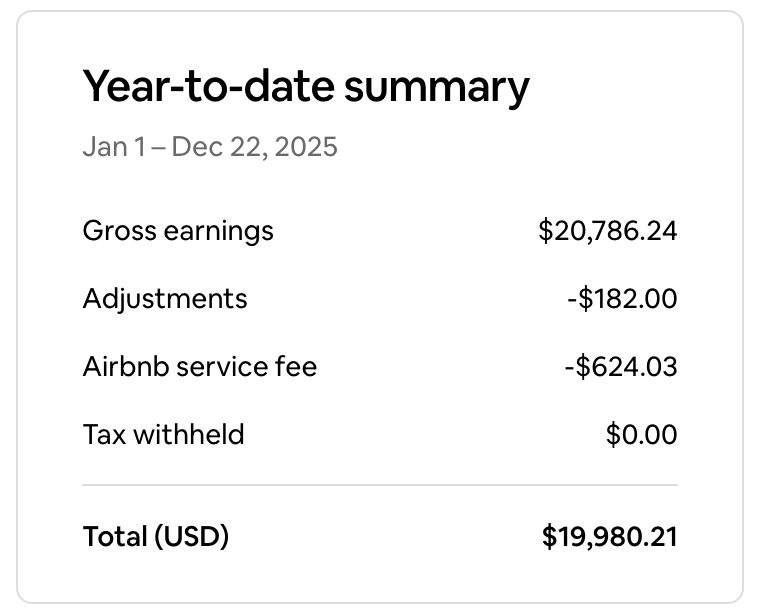

The “before and after” photos below tell the story, but here’s the punchline: the main house rented for $3,200/month, and this ADU became an Airbnb income engine. I still own the property (I never sell real estate, by the way). It’s located in a hot pocket, and this year alone the ADU has generated $20k, tax-advantaged of course. And the best part, I don’t have to lift a finger as I have an Airbnb manager in charge making sure the place stays booked through the year!

If you want the exact system I used to find and acquire probate opportunities when I was starting out, reply to this email and I’ll share it.

✅ ADU feasibility checklist: 7 quick questions

So you’re thinking about the possibilities.. or maybe you already have something in mind. But before calling an architect, ask yourself these seven questions. They will tell you whether it is worth diving in.

Is my property in an area that allows ADUs at all?

Many cities and states are now ADU friendly, but the rules vary. Some allow detached ADUs, others only internal or attached. Start with your local zoning code or planning department website.Do lot size, setbacks, and height limits still work once I add an ADU?

Even in ADU friendly zones, you still need to respect how far buildings must be from property lines, alleys, and neighboring homes.Can I create a legal, safe separate entrance?

Especially for basement and internal ADUs, you need a dedicated entry and proper egress windows or doors for fire safety. I saw that in the deal when during the tour!Is there a realistic path to utility connections?

Your ADU needs water, sewer, power, and possibly gas. You need to know whether you are running new lines, tapping existing ones, or adding sub-meters.Will parking rules kill the deal?

Some jurisdictions require an extra parking space for each ADU. Others waive this near public transit. Know the expectation.What will the finished unit realistically rent for?

Use rental comps for small studios and one-bedroom units in your micro-area, not downtown Class A numbers. Being conservative up front saves pain later.Does the timeline and budget fit your capital and patience?

ADUs are a construction project. Permitting and inspections take time. If you are tight on cash or need instant cash flow, you may need to phase the plan or partner with someone.

If you can answer most of these with a "yes" or "I know the path," it is worth taking the next step.

📝 Permitting and zoning, explained like a landlord

Every city has its own details, but the workflow is similar almost everywhere.

Step 1 - Confirm zoning and ADU allowances

Find out:

Is an ADU allowed by right in this zoning district, or will I need a variance or special use permit?

Can I build a detached ADU, or only internal / attached?

What are the maximum size limits, height limits, and floor-area ratio rules?

You can usually get a clear answer from:

The zoning map and zoning code on your city or county website

A quick visit or call to the planning or building department

Document whatever they tell you. Screenshots, emails, and written notes will save you time later.

Step 2 - Understand building code requirements

An ADU must meet residential building code standards for:

Minimum ceiling heights

Fire separation between units

Egress windows or doors from sleeping areas

Smoke and carbon monoxide detectors

Insulation, structural, and electrical standards

A local architect, designer, or experienced contractor will know these cold. A short paid consultation can save thousands in change orders.

Step 3 - Design, drawings, and submission

Expect to prepare:

A site plan that shows the existing structure, the new ADU, setbacks, and parking

Floor plans and elevations of the ADU

Structural details and key mechanical, electrical, and plumbing layouts

You submit these with a permit application. The city reviews, asks questions, and eventually issues a building permit once it is satisfied.

Step 4 - Inspections and final approval

As work progresses, inspectors will visit to check:

Footings and foundations

Framing

Rough plumbing and electrical

Insulation

Final life safety, fixtures, and finishes

After final inspection, you receive a certificate of occupancy or final sign off that allows you to legally rent the unit.

📊 A simple ADU case study: turning a regular deal into a smoky one

Here is using my ADU as an example with real numbers so you can see how the math shifts.

A single-family rental:

Bought from probate: $235,000 (Appraised for $449,000 after renovations)

Paid deal finder: $10,000

Renovated main house: $40,000

Main house monthly rent: $3,200

Annual rental income: $38,400

Monthly mortgage: $2,800 ($33,600 annual)

At this income level, after mortgage and maintenance, the property is basically break-even.

Developing the ADU:

Converted walk-out basement to renovated ADU: $26,000

Airbnb average annual income: $19,000

Now the combined property looks like this:

Total cost basis before ADU: $285,000

Total cost basis after ADU: $311,000

Total annual rent: $38,400 + $19,000 = $57,400

I essentially turned a break-even single-family into a two-unit rental with a much stronger income profile.

On a very simple gross yield basis:

Before ADU: $38,400 on $285,000 basis is about 13.47%

After ADU: $42,600 on $311,000 is about 18.45%

That is before tax benefits, long term rent growth, and increase in appraised value. The numbers get more interesting if you lock in good financing or if rents rise over time.

Is every ADU this clean? No. But this is the type of math that makes the hassle worthwhile.

⚠️ Common ADU pitfalls to avoid

A few patterns show up again and again when ADU projects go sideways. Here are the big ones to avoid.

Underestimating soft costs

Design, permits, utility connection fees, impact fees, and contingencies can easily add 15 to 25 percent on top of raw construction cost. Build that into your budget from day one.Ignoring neighborhood rent ceilings

Just because a downtown studio rents for 2,000 does not mean a backyard studio in a quieter area will do the same. Use conservative comps.Not planning for long lead times

Permits, utility company approvals, and inspections can stretch timelines. Pad your schedule and your holding costs.Confusing "allowed" with "simple"

A city may allow ADUs on paper, but the actual review and inspection culture can still be strict. Talk to local investors who have built ADUs before. Their war stories are valuable.Forgetting long term management

Two units on one lot can mean parking friction, noise issues, and questions about who uses which outdoor space. Set expectations in leases and house rules up front.

🧭 When does an ADU make sense for you?

An ADU may be a strong move if:

You own a property in a stable or growing area with unused yard, garage, or basement space

Zoning and neighborhood character support a second unit without overbuilding

You are comfortable managing a construction process or have a trusted partner

You are playing a long game and can hold for several years to realize full value

It may not be the right fit if you are:

Very tight on capital

In a market that is hostile to ADUs or highly restrictive

Looking for a quick flip with minimal complexity

ADUs are not magic, but when the basics line up, they can quietly transform the economics of a property.

After ADUs, we will move into microunits, redevelopments, house hacking, and seller financing, each with:

Plain English explanations

Example numbers

Templates and checklists you can use in your own investing

If you have a specific ADU question or a property you are thinking about for this strategy, reply to this email and share a quick summary. We may use a version of it as a case study in a future issue.

🙏🏾 Thanks for reading!

Stay in the loop with us! If you’ve received this newsletter from someone else, subscribe here.

Stay blessed and Do Something!

— Dami Fadipe